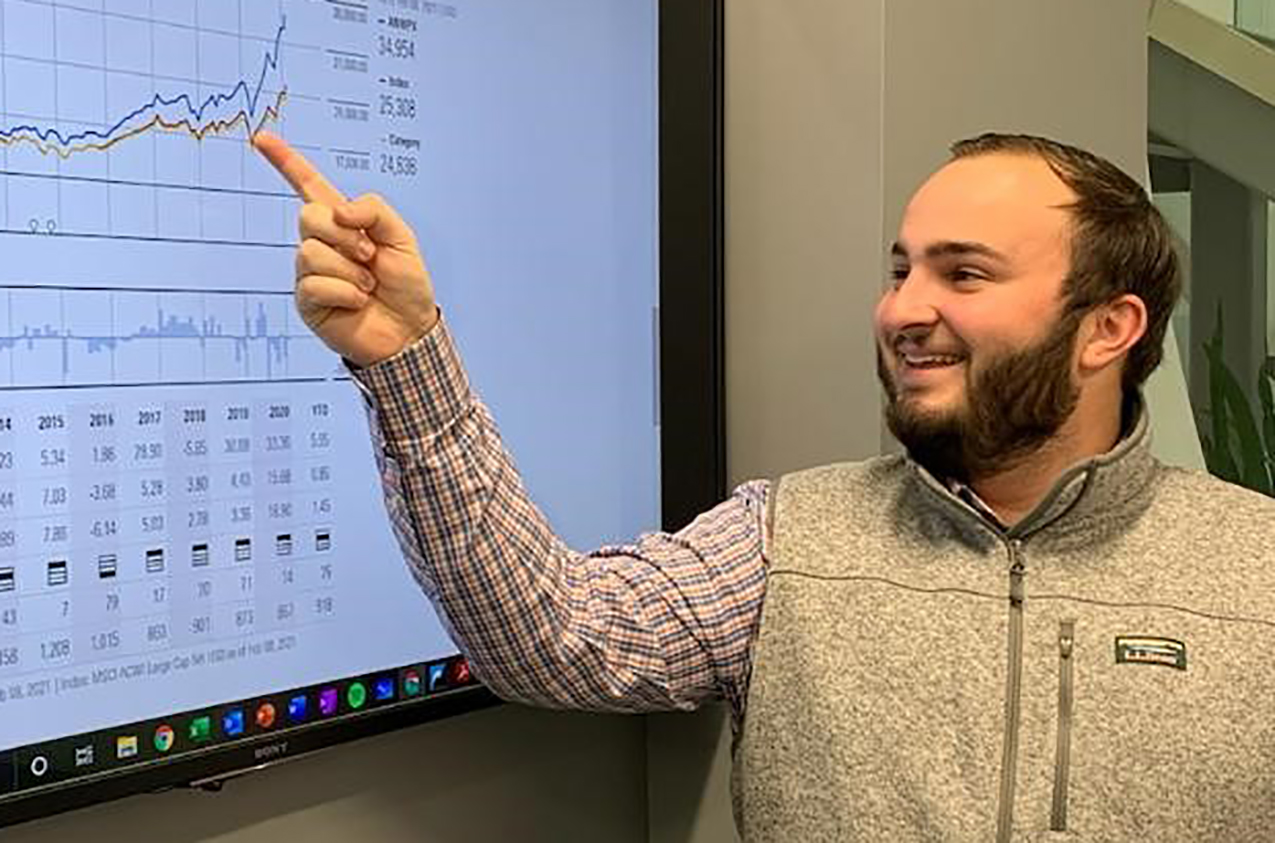

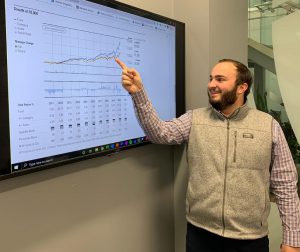

In the new age of trading apps and stock conversations on social media, more and more people are getting involved in the world of personal finance. As this change happens, we are currently in one of the largest wealth transfers in history with the aging of the baby boomers. Throughout all of this, young people are put in a place where they have a big financial situation to deal with, and many feel they can do this alone. So, this month, I am going to talk about the benefits of having a financial professional in your corner.

In the new age of trading apps and stock conversations on social media, more and more people are getting involved in the world of personal finance. As this change happens, we are currently in one of the largest wealth transfers in history with the aging of the baby boomers. Throughout all of this, young people are put in a place where they have a big financial situation to deal with, and many feel they can do this alone. So, this month, I am going to talk about the benefits of having a financial professional in your corner.

Using a professional, on a very surface level, gives you a sounding board for ideas and plans, goals, fears, and dreams in life. Financial professionals have seen many different situations, and have the ability to create plans and ideas to help their clients reach those goals and dreams down the road. If nothing else, a professional is a person well versed in topics like retirement planning, insurance planning, wealth management, social security, and many others. Most even have connections to estate planning attorneys, CPA’s, and mortgage lenders to ensure their clients are covered in all the major areas of personal finance.

Beyond that, they are very rigorously tested. They have the title “professional” for a reason, because it takes an extensive amount of education, training, knowledge and skill to manage investments and insurance planning. There are separate examinations for insurance and investments, and numerous different designations. Each professional that holds these licenses is required to continue their education on an ongoing basis to stay up to date on new laws and regulations, because they are always changing.

Next, life is always a moving target. So is your financial picture. There isn’t ever a one-size-fits -all approach to planning, as each person is different. So, even if you are not ready to start investing thousands of dollars right away, it is good to have a relationship with someone who can give you ideas about saving, debt repayment, and other basics.

Finally, they can provide an increase in your level of confidence. Many do not have the time or desire to manage their investment portfolio or create their own financial plan. It can be very comforting knowing you have someone working in your best interests, and making sure you are sticking to the plan. Having that sense of security and accountability allows for clients to feel cared for.

Each professional is going to be different. For me, I focus on the relationship. I am there whenever a client has a question or needs help, and when going through all of life’s stages, from college to career, family, and retirement. It is paramount to build a foundation of trust and honesty, because when it comes to money, there is no other way.

Send me an email, or give me a call. A video call works too. Absolutely no cost on your end, just your time. Let’s chat!

Email: [email protected]

Phone: 419-725-7358

The information in this commentary is intended for informational purposes only, and is not intended to imply a recommendation of any products or securities mentioned. Please note that individual situations can vary and you are encouraged to seek such advice from your financial advisor.

2. Cut out unnecessary spending: Again, I know, you have heard this all before, right? The reality is, not everyone is honest with their expenses. However, most of us are guilty of this from time to time. I know I picked up some unnecessary things in quarantine – maybe an extra streaming service, more DoorDash, and a LOT more golf, but these are the things that ultimately ruin your budget, because they slip through the cracks. Be quick to catch on to the fact that the key to all of this is discipline.

2. Cut out unnecessary spending: Again, I know, you have heard this all before, right? The reality is, not everyone is honest with their expenses. However, most of us are guilty of this from time to time. I know I picked up some unnecessary things in quarantine – maybe an extra streaming service, more DoorDash, and a LOT more golf, but these are the things that ultimately ruin your budget, because they slip through the cracks. Be quick to catch on to the fact that the key to all of this is discipline.

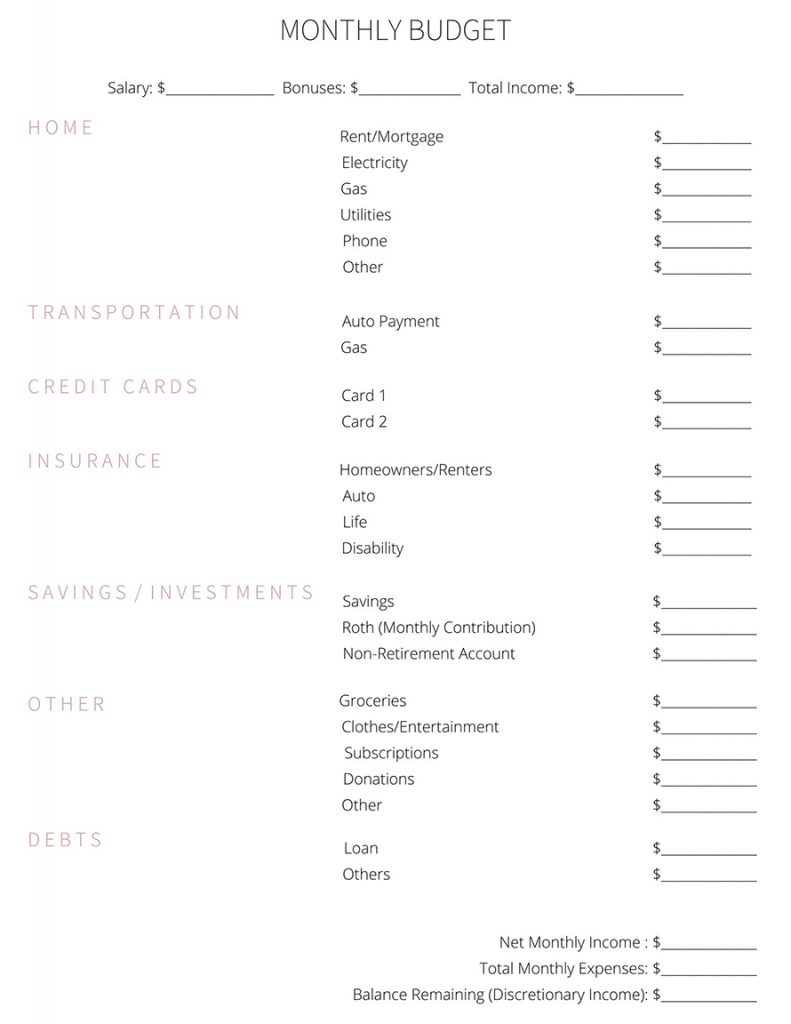

First, let’s review your budget. My husband and fellow financial advisor, Nick, and I review our budget once a year at the end of the calendar year. This month, we’ll have some budget shifting to do because there are numerous factors that both increased and cut costs.

First, let’s review your budget. My husband and fellow financial advisor, Nick, and I review our budget once a year at the end of the calendar year. This month, we’ll have some budget shifting to do because there are numerous factors that both increased and cut costs.

This is a common question I get when I first sit down with an individual or couple.

This is a common question I get when I first sit down with an individual or couple.

However, this long holiday weekend (happy belated Fourth of July!) brought some time to reflect on these past five years. While year one looks vastly different than today, one question from clients has remained the same: “Megan, how come they don’t teach this in school?”

However, this long holiday weekend (happy belated Fourth of July!) brought some time to reflect on these past five years. While year one looks vastly different than today, one question from clients has remained the same: “Megan, how come they don’t teach this in school?”

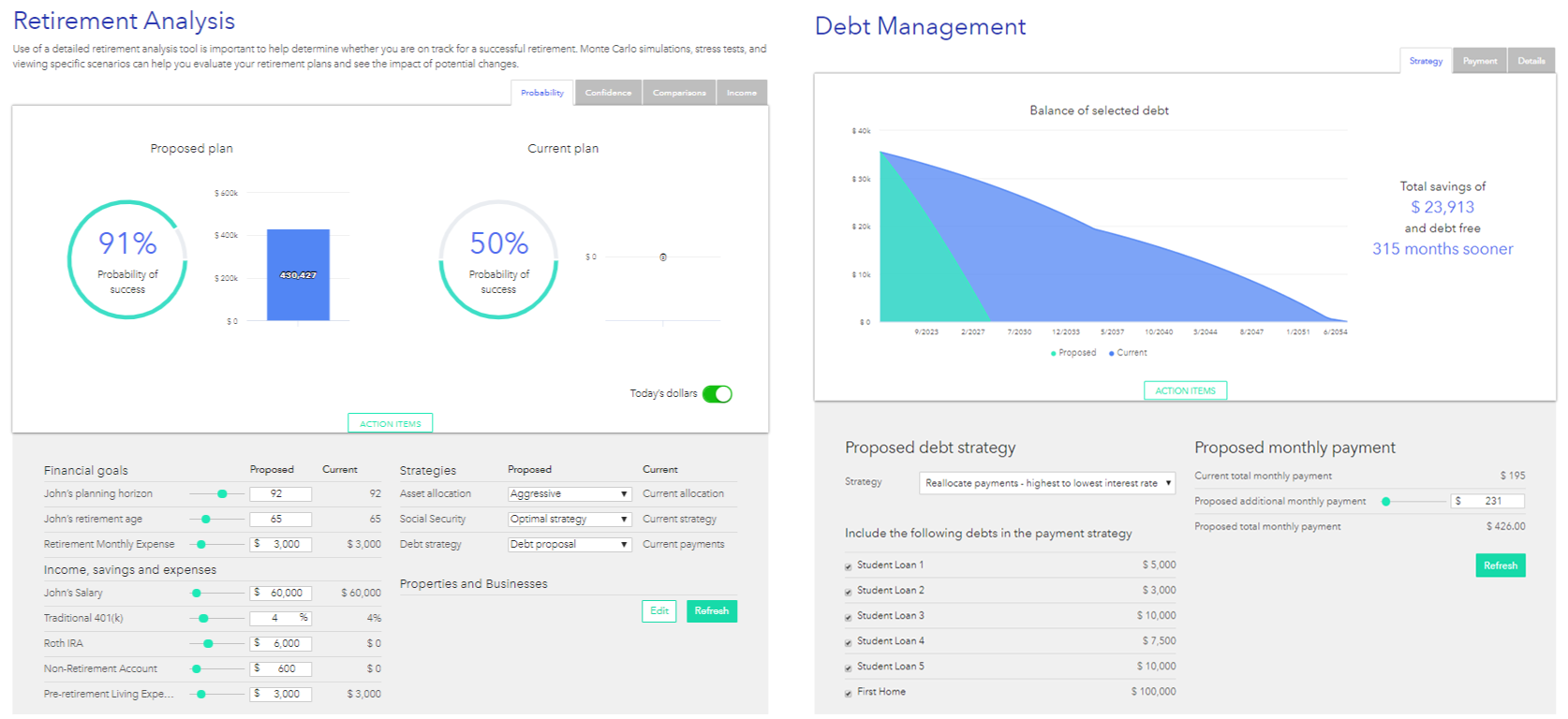

Above, you can see a few screenshots of the many tools that Right Capital provides my clients. Whether they are getting started and trying to figure out how to pay off student loans (debt management), or want to know if they are on track to meet their long-term goals (retirement analysis), this platform helps them visualize the importance of proper planning. I want to make sure my clients understand my job doesn’t end at selecting investments, but also educating them in all facets of their financial picture.

Above, you can see a few screenshots of the many tools that Right Capital provides my clients. Whether they are getting started and trying to figure out how to pay off student loans (debt management), or want to know if they are on track to meet their long-term goals (retirement analysis), this platform helps them visualize the importance of proper planning. I want to make sure my clients understand my job doesn’t end at selecting investments, but also educating them in all facets of their financial picture. About Megan:

About Megan:

Annual Review

Annual Review Securities and investment advisory services offered through Osaic Wealth, Inc., member FINRA/SIPC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth.

Securities and investment advisory services offered through Osaic Wealth, Inc., member FINRA/SIPC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth.