Phil Johnson

A “total planning” approach.

Contact Phil.

Phil Johnson, Savage financial advisor and partner, is personable and passionate as he delivers financial advice for his individual and small business clients. He has a long tradition of growth, specializing in total planning.

Phil is a lifetime Toledo native and a graduate of the University of Toledo. He is married to his wife, Terri, and has two children, Nicholas and Danielle.

At Your Service

Our experienced team is here to assist you with a variety of financial needs.

For long-term investors, strong absolute returns and downside protection are both essential goals. To reach them, we believe individuals need to look beyond recent market performance and take a longer-term view. The priority should be to invest in a diversified portfolio that can weather a range of market environments.

*Diversification does not guarantee a profit or protect against a loss in a declining market. It is a method used to help manage investment risk.

Our Process

-

Discovery and goal definition meeting

-

Personalize a complete financial plan

-

Annual investment meeting and plan updates as needed

Our Service Offerings

Retirement Income Consulting

Maximize income distributions off an existing asset base.

Employer Plan Consulting

Small company retirement plans.

Strategic Tax Planning

Creating tax efficiencies to maximize income.

Behavioral Financial Advice

Align actions with financial beliefs.

Account Consolidation

Consolidating accounts for easier management and record-keeping.

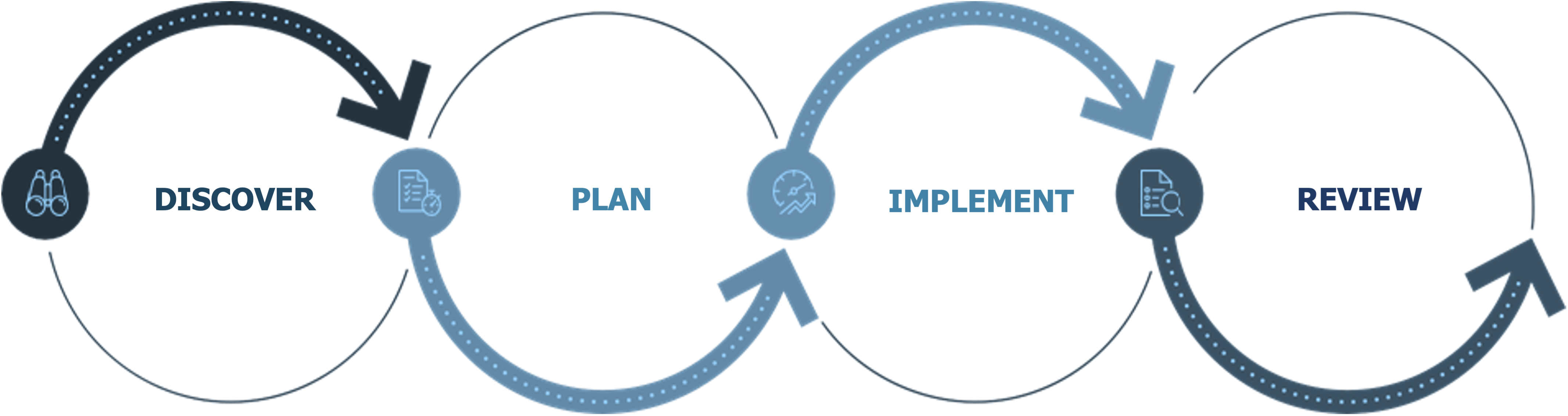

Financial Planning Process

We’ll work closely with you to understand your goals, values, current financial status, income needs and the future you imagine for yourself.

We’ll develop a written plan or proposal that will be presented to you, outlining recommended income, strategies, and benchmarks we’ll measure.

We will select the tools and resources needed to implement your strategy and to help meet your unique needs and goals.

We’ll regularly review the progress of your plan against benchmarks and changes in your life, then make adjustments as needed.