Savage and Associates announced the hiring of seven college students with northwest Ohio ties to join the advisor internship program this summer.

Savage and Associates announced the hiring of seven college students with northwest Ohio ties to join the advisor internship program this summer.

The program provides formal training, access to mentors, opportunities to acquire professional licenses, and other valuable experiences. Joining the program are the following students:

- Hannah Crites – Bowling Green State University (junior); finance major; Bowling Green, Ohio (hometown).

- Katelyn Maloney – Bowling Green State University (junior); finance major; Perrysburg, Ohio (hometown)

- Stephanie Miller – Bowling Green State University (junior); finance major; Waterville, Ohio (hometown).

- Chase Monaghan – University of Dayton (junior); finance major; Perrysburg, Ohio (hometown).

- Teddy Perozek – Ohio State University (junior); marketing major; Ottawa Hills, Ohio (hometown).

- Megan Reiter – Bowling Green State University (junior); finance major; Forest, Ohio (hometown).

- Kaden Sanford – University of Toledo (junior); finance major; Lyons, Ohio (hometown).

Along with working to acquire their life and health license, the students will learn some of the basic risk products, meet regularly with industry experts, learn the importance of ensuring clients are well rounded in their portfolio of bank accounts, investments and insurance, as well as progress in several areas to enhance their industry knowledge. The internship program runs through mid-August.

Students interesting in learning about the advisor internship program should contact Liz Harmon, director of recruiting and practice development, at 419-725-7211 or [email protected].

For the ninth consecutive year, Savage and Associates has been named one of the region’s top workplaces by the Toledo Blade. Additionally, the company received a specialty award for exhibiting clear direction toward the future.

For the ninth consecutive year, Savage and Associates has been named one of the region’s top workplaces by the Toledo Blade. Additionally, the company received a specialty award for exhibiting clear direction toward the future.

Savage and Associates has been announced as one of only 10 financial advisory firms across the country selected for the Invest in Others 2024 Charitable Champions List.

Savage and Associates has been announced as one of only 10 financial advisory firms across the country selected for the Invest in Others 2024 Charitable Champions List.

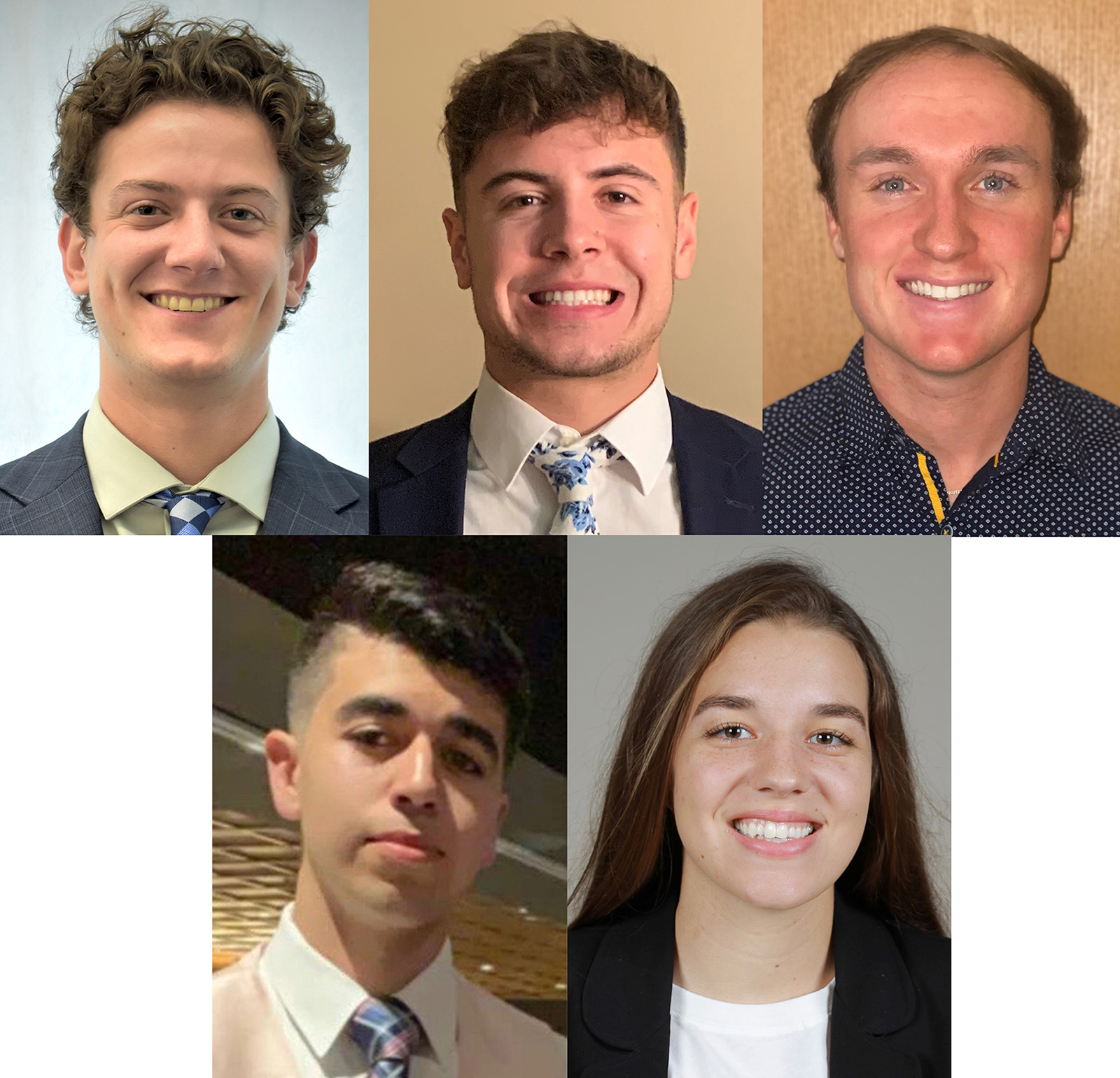

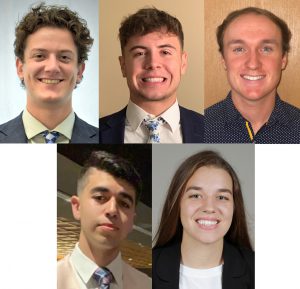

Savage and Associates announced the hiring of five college students with northwest Ohio ties to join the advisor internship program this summer.

Savage and Associates announced the hiring of five college students with northwest Ohio ties to join the advisor internship program this summer.

Savage and Associates announced today the addition of

Savage and Associates announced today the addition of

For the eighth consecutive year, Savage and Associates has been named one of the region’s top workplaces by the Toledo Blade. Additionally, Savage received the superior values award. Additionally, J.R. Toland, president and CEO, Savage, received the superior leadership award for the fourth time in eight years.

For the eighth consecutive year, Savage and Associates has been named one of the region’s top workplaces by the Toledo Blade. Additionally, Savage received the superior values award. Additionally, J.R. Toland, president and CEO, Savage, received the superior leadership award for the fourth time in eight years.

For the seventh consecutive year, Savage and Associates has been named one of the region’s top workplaces by the Toledo Blade. Additionally, Savage received the superior values award.

For the seventh consecutive year, Savage and Associates has been named one of the region’s top workplaces by the Toledo Blade. Additionally, Savage received the superior values award.

The list recognizes advisory firms for their exemplary efforts to give back to their communities by promoting a culture of philanthropy and volunteerism amongst employees and financial advisors. Submissions were evaluated blindly by a panel of judges based on criteria including employee benefits, company contributions, and philanthropic events and programs.

The list recognizes advisory firms for their exemplary efforts to give back to their communities by promoting a culture of philanthropy and volunteerism amongst employees and financial advisors. Submissions were evaluated blindly by a panel of judges based on criteria including employee benefits, company contributions, and philanthropic events and programs.

Savage and Associates hired five local college students with northwest Ohio ties to join the advisor internship program this summer.

Savage and Associates hired five local college students with northwest Ohio ties to join the advisor internship program this summer.

For the sixth consecutive year, Savage and Associates has been named one of the region’s top workplaces by the Toledo Blade. Additionally, J.R. Toland, president and CEO, Savage, received the superior leadership award for the third time in six years.

For the sixth consecutive year, Savage and Associates has been named one of the region’s top workplaces by the Toledo Blade. Additionally, J.R. Toland, president and CEO, Savage, received the superior leadership award for the third time in six years.