Savage and Associates, a financial and insurance services company focused on individuals, families, and businesses, has named Marianne Peters as chief operating officer (COO). As COO, Peters will lead the company’s systems and processes that promote the mission, vision and values, drive efficiency improvements, manage training, and assist with the company’s overall strategy and plan. She previously served as Savage’s director of people and performance, and will continue to report directly to president and chief executive officer, J.R. Toland.

Savage and Associates, a financial and insurance services company focused on individuals, families, and businesses, has named Marianne Peters as chief operating officer (COO). As COO, Peters will lead the company’s systems and processes that promote the mission, vision and values, drive efficiency improvements, manage training, and assist with the company’s overall strategy and plan. She previously served as Savage’s director of people and performance, and will continue to report directly to president and chief executive officer, J.R. Toland.

“Marianne is the perfect choice to guide Savage into the future,” Toland stated. “She has made a strong and impressionable impact since joining the company. Well respected and admired for her skills, she has outstanding forward thinking and a unique ability to enhance processes and increase output – all with the goal of improving the experience for the clients we serve.”

Peters has been with the company since 2012.

Prior to joining Savage, she was controller for companies in the Columbus, OH and Columbia MO, regions. She was internal audit project lead for Motorola, and an associate for PricewaterhouseCoopers.

She is a board member for Imagination Station, serves as chair for the Susan G. Komen Northwest Ohio chapter leadership council, and assists with various community projects and events throughout the region.

Originally from Chesterfield, Missouri, Peters has a Bachelor of Science in accounting from Indiana University. She and her husband, Chris, have two children, Sydney and Cole.

Savage and Associates announced the addition of two associates to the team – both with close ties to northwest Ohio. Lauren Hehl-Myers and Kirby McLoughlin will assist clients with saving, risk management, group health and protecting assets.

Savage and Associates announced the addition of two associates to the team – both with close ties to northwest Ohio. Lauren Hehl-Myers and Kirby McLoughlin will assist clients with saving, risk management, group health and protecting assets.

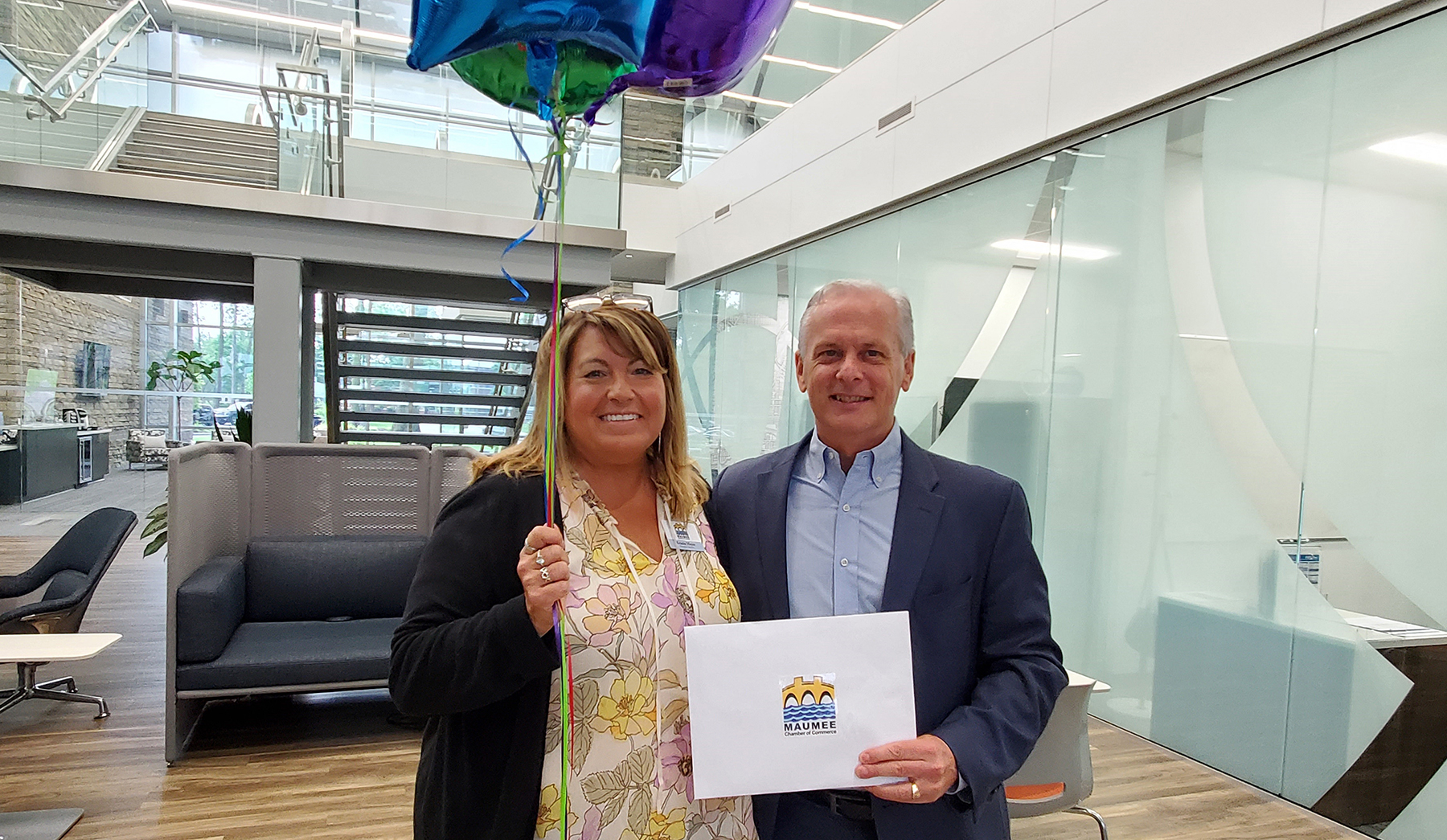

Savage and Associates has been named the recipient of the Maumee River Award from the Maumee Chamber of Commerce during their 46th annual Hometown Hero awards banquet.

Savage and Associates has been named the recipient of the Maumee River Award from the Maumee Chamber of Commerce during their 46th annual Hometown Hero awards banquet.

“We are proud to honor J.R. Toland as a Pacemaker, the criteria for which is ‘outstanding achievement in business or profession and service to The University of Toledo area,’” stated Anne L. Balazs, Ph.D., dean, The University of Toledo College of Business and Innovation. “Mr. Toland joins a long line of distinguished men and women from the Toledo area who are making a difference through their contributions to the community. This award dates back to 1963 and Mr. Toland is another shining example of an ethical and successful leader – a Pacemaker to celebrate!”

“We are proud to honor J.R. Toland as a Pacemaker, the criteria for which is ‘outstanding achievement in business or profession and service to The University of Toledo area,’” stated Anne L. Balazs, Ph.D., dean, The University of Toledo College of Business and Innovation. “Mr. Toland joins a long line of distinguished men and women from the Toledo area who are making a difference through their contributions to the community. This award dates back to 1963 and Mr. Toland is another shining example of an ethical and successful leader – a Pacemaker to celebrate!”

Tony Desch, financial advisor

Tony Desch, financial advisor

“Savage is delighted to receive this honor for the fifth year in a row,” stated J.R. Toland, president and CEO, Savage and Associates. “I am so proud of our team of more than 120 associates, across four locations, as they carried on with such dedication and optimism amid the ongoing pandemic. Our continued growth is due to having so many high-caliber, energetic people that simply love serving others.”

“Savage is delighted to receive this honor for the fifth year in a row,” stated J.R. Toland, president and CEO, Savage and Associates. “I am so proud of our team of more than 120 associates, across four locations, as they carried on with such dedication and optimism amid the ongoing pandemic. Our continued growth is due to having so many high-caliber, energetic people that simply love serving others.”

“Dan has an outstanding reputation throughout multiple northwest Ohio counties,” stated J.R. Toland, president and CEO, Savage. “We are thrilled to have him on board, and this now gives clients even easier access as we expand to our fourth location.”

“Dan has an outstanding reputation throughout multiple northwest Ohio counties,” stated J.R. Toland, president and CEO, Savage. “We are thrilled to have him on board, and this now gives clients even easier access as we expand to our fourth location.”

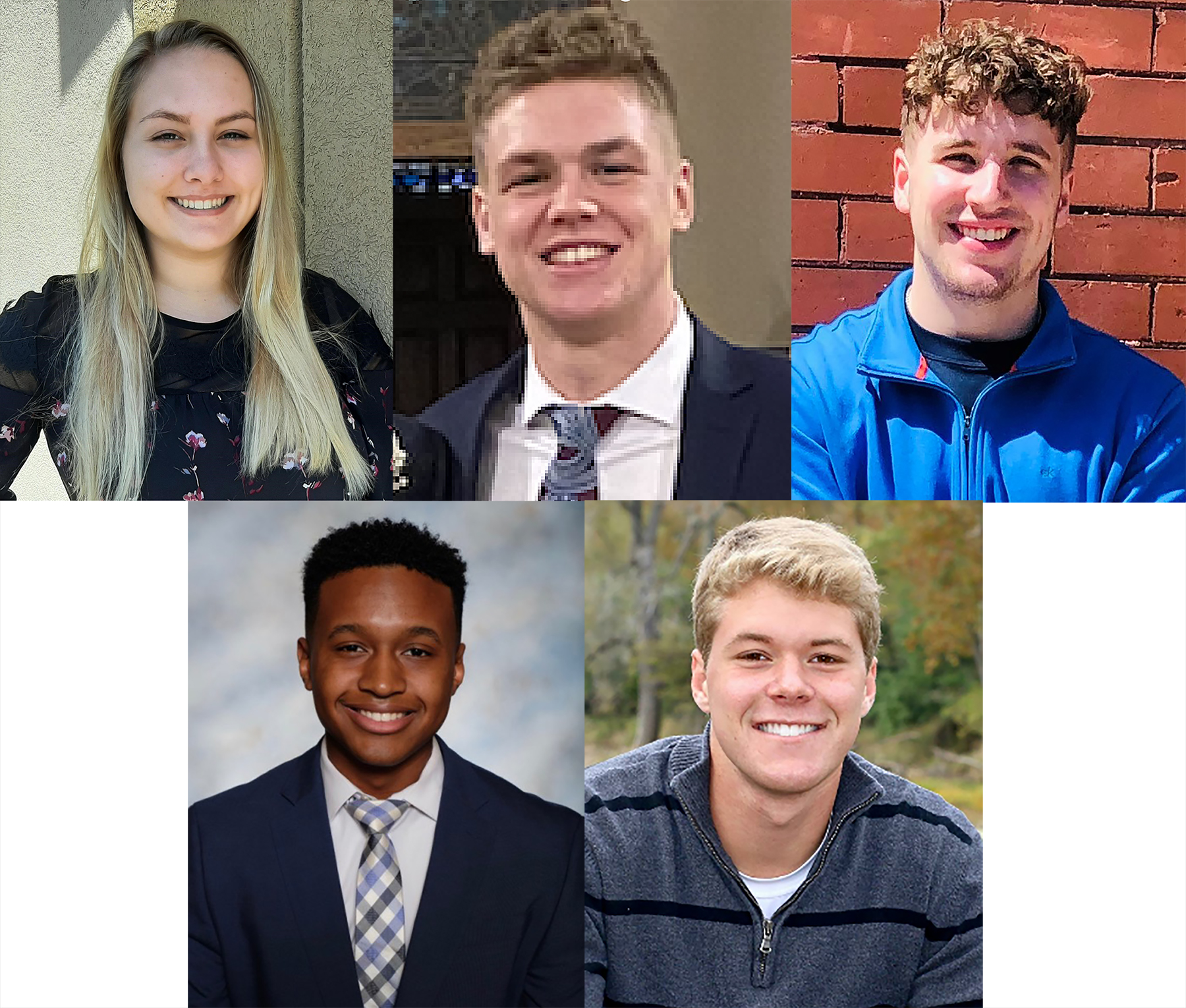

Savage and Associates has hired four college students to join the advisor internship program this summer which provides formal training, access to mentors, opportunity to acquire professional licenses, and other valuable experiences.

Savage and Associates has hired four college students to join the advisor internship program this summer which provides formal training, access to mentors, opportunity to acquire professional licenses, and other valuable experiences.