Life is a beautiful journey filled with precious moments and cherished memories. However, it is essential to prepare for the unexpected and ensure the well-being of your loved ones even when you are no longer around. That is where life insurance becomes an invaluable tool. Life insurance provides a safety net for your family and offers peace of mind by ensuring their financial security in the event of your untimely demise. In this blog post, we will explore how Savage can help you navigate the world of life insurance, providing comprehensive solutions to protect your family’s financial future.

Life is a beautiful journey filled with precious moments and cherished memories. However, it is essential to prepare for the unexpected and ensure the well-being of your loved ones even when you are no longer around. That is where life insurance becomes an invaluable tool. Life insurance provides a safety net for your family and offers peace of mind by ensuring their financial security in the event of your untimely demise. In this blog post, we will explore how Savage can help you navigate the world of life insurance, providing comprehensive solutions to protect your family’s financial future.

1. Customized Coverage to Meet Your Needs:

At Savage, we understand that every individual and family has unique requirements. Our team of experienced professionals will work closely with you to assess your specific needs and goals. Whether you are looking for term life insurance to cover a specific period or permanent life insurance that offers lifelong protection, we’ll tailor a policy that aligns with your circumstances, budget, and long-term objectives.

2. Comprehensive Financial Protection:

If you are the primary breadwinner in your family, your sudden absence could leave your dependents in a challenging financial situation. Life insurance can bridge this gap by providing a steady income stream to replace the earnings they relied upon. The death benefit, paid out by the policy, can assist your family in covering funeral expenses, outstanding debts, mortgage payments, and day-to-day living costs. It ensures that your loved ones can maintain their quality of life during a difficult transition.

3. Expert Guidance and Education:

Navigating the world of life insurance can be overwhelming, with various policy options and technical jargon to decipher. Savage takes pride in offering personalized guidance and education throughout the process. Our team will patiently explain the different types of policies, their benefits, and any associated riders or add-ons, empowering you to make informed decisions about your coverage. We believe that by understanding the nuances of life insurance, you can select the most suitable policy for your needs.

4. Flexibility and Adaptability:

Life is dynamic, and your insurance needs may change over time. At Savage we recognize the importance of adaptability. If your circumstances evolve, such as starting a family, purchasing a home, or retiring, we can review your policy and recommend adjustments to ensure your coverage remains relevant. We are committed to building lasting relationships with our clients, providing ongoing support and maintaining open lines of communication to address any changes or concerns.

5. A Partner in Financial Security:

Choosing Savage means partnering with a trusted ally dedicated to your financial security. Our team takes the time to understand your financial goals beyond life insurance, considering your comprehensive financial plan. We can help you explore additional strategies, such as retirement planning, investment options, and wealth preservation, to create a well-rounded approach that safeguards your family’s future and builds a legacy.

Life insurance is an essential component of a comprehensive financial plan, offering peace of mind and protecting your loved ones from unforeseen circumstances. Savage strives to be your trusted partner, guiding you through the intricacies of life insurance and providing tailored solutions that align with your unique needs and aspirations. With our expertise, personalized service, and commitment to your financial security, you can confidently embrace the future, knowing that your loved ones will be protected no matter what lies ahead. Contact a Savage advisor today to embark on your journey toward a secure future.

To learn more, check out our Life Insurance page: https://savageandassociates.com/life-insurance/

Savage and Associates announced the hiring of seven college students with northwest Ohio ties to join the advisor internship program this summer.

Savage and Associates announced the hiring of seven college students with northwest Ohio ties to join the advisor internship program this summer.

For the ninth consecutive year, Savage and Associates has been named one of the region’s top workplaces by the Toledo Blade. Additionally, the company received a specialty award for exhibiting clear direction toward the future.

For the ninth consecutive year, Savage and Associates has been named one of the region’s top workplaces by the Toledo Blade. Additionally, the company received a specialty award for exhibiting clear direction toward the future.

Savage and Associates has been announced as one of only 10 financial advisory firms across the country selected for the Invest in Others 2024 Charitable Champions List.

Savage and Associates has been announced as one of only 10 financial advisory firms across the country selected for the Invest in Others 2024 Charitable Champions List.

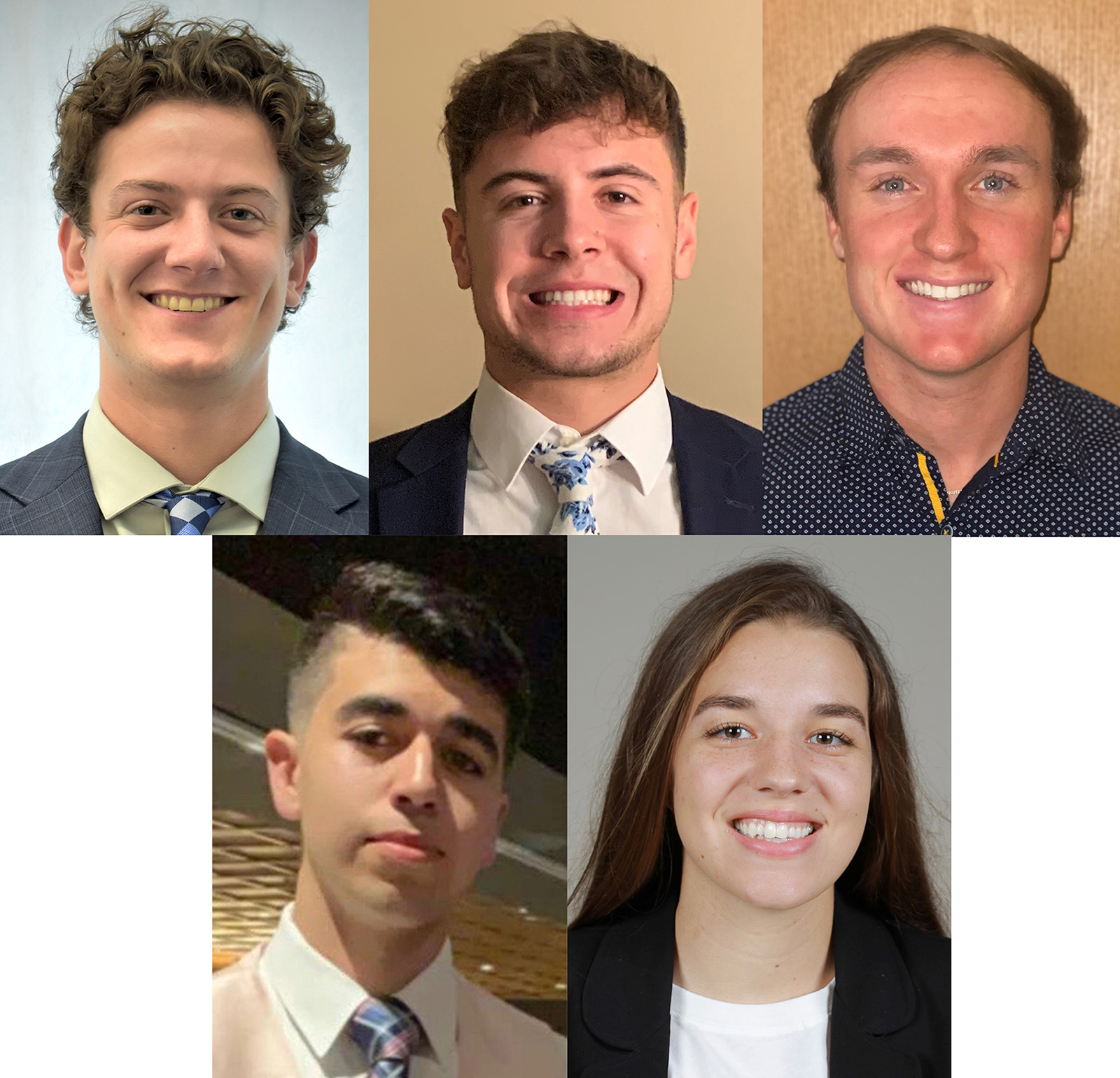

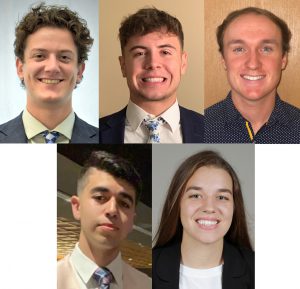

Savage and Associates announced the hiring of five college students with northwest Ohio ties to join the advisor internship program this summer.

Savage and Associates announced the hiring of five college students with northwest Ohio ties to join the advisor internship program this summer.

Savage and Associates announced today the addition of

Savage and Associates announced today the addition of

For the eighth consecutive year, Savage and Associates has been named one of the region’s top workplaces by the Toledo Blade. Additionally, Savage received the superior values award. Additionally, J.R. Toland, president and CEO, Savage, received the superior leadership award for the fourth time in eight years.

For the eighth consecutive year, Savage and Associates has been named one of the region’s top workplaces by the Toledo Blade. Additionally, Savage received the superior values award. Additionally, J.R. Toland, president and CEO, Savage, received the superior leadership award for the fourth time in eight years.

For the seventh consecutive year, Savage and Associates has been named one of the region’s top workplaces by the Toledo Blade. Additionally, Savage received the superior values award.

For the seventh consecutive year, Savage and Associates has been named one of the region’s top workplaces by the Toledo Blade. Additionally, Savage received the superior values award.

The list recognizes advisory firms for their exemplary efforts to give back to their communities by promoting a culture of philanthropy and volunteerism amongst employees and financial advisors. Submissions were evaluated blindly by a panel of judges based on criteria including employee benefits, company contributions, and philanthropic events and programs.

The list recognizes advisory firms for their exemplary efforts to give back to their communities by promoting a culture of philanthropy and volunteerism amongst employees and financial advisors. Submissions were evaluated blindly by a panel of judges based on criteria including employee benefits, company contributions, and philanthropic events and programs.

Savage and Associates hired five local college students with northwest Ohio ties to join the advisor internship program this summer.

Savage and Associates hired five local college students with northwest Ohio ties to join the advisor internship program this summer.