We hear the word, “prepare,” in some form, quite often from clients.

“I wish I had better prepared.”

“Can you tell me how I can prepare for the future?”

… and so on.

It is not uncommon when something as catastrophic as a pandemic leaves the world thinking more and more about some basic necessities of life that are sometimes overlooked – and wishing they had prepared. COVID-19 has heightened our awareness in many ways. Many can lay claim to knowing someone who contracted the virus, whether a family member, friend, co-worker, etc. Maybe it was even our own first-hand experience!

It has turned the focus of many toward life insurance.

It is such an important piece in life, which also happens to be one of the services at Savage that is seeing an exponentially increased awareness.

There are those who think they are covered sufficiently through their life insurance policy at work. The reality is that may not always be enough.

In a study published in 2020 by LIMRA (an organization that helps 600+ insurance/financial services companies across 73 companies increase marketing effectiveness), and Life Happens (nonprofit providing information to consumers to help make smart insurance choices) held a study just last year. Some fascinating statistics:

- Nearly a quarter of American households do not have coverage, and another 30 million do not have enough. (That’s roughly half of all households!)

- The average coverage gap between what people have, and what they need, is about $200,000.

- About 44 percent of households said they would face financial hardship within six months if the primary wage earner were to die prematurely. For 28 percent of households, financial hardship would hit within one month.

- More than half say they haven’t purchased life insurance because they don’t know how much they need or what type to buy.

- Six in 10 Americans say they have a heightened awareness of the importance of life insurance due to COVID-19.

Kevin Baumeier

While these are alarming statistics, there is good news. Almost 30 percent of adults are more likely to buy life insurance over the next year. Are you one of them?

It’s more inexpensive than people realize, and to make life easier, we even accept e-signatures to ease the process.

If you already work with a financial professional at Savage, reach out to them for their insight. If not, and you would like to speak with someone about life insurance, contact Kevin Baumeier, CLU®, manager of risk services, at 419-725-7243, or [email protected].

Kevin Baumeier is not registered with Osaic Wealth, Inc.

For the sixth consecutive year, Savage and Associates has been named one of the region’s top workplaces by the Toledo Blade. Additionally, J.R. Toland, president and CEO, Savage, received the superior leadership award for the third time in six years.

For the sixth consecutive year, Savage and Associates has been named one of the region’s top workplaces by the Toledo Blade. Additionally, J.R. Toland, president and CEO, Savage, received the superior leadership award for the third time in six years.

Savage and Associates, a financial and insurance services company focused on individuals, families, and businesses, has named Marianne Peters as chief operating officer (COO). As COO, Peters will lead the company’s systems and processes that promote the mission, vision and values, drive efficiency improvements, manage training, and assist with the company’s overall strategy and plan. She previously served as Savage’s director of people and performance, and will continue to report directly to president and chief executive officer, J.R. Toland.

Savage and Associates, a financial and insurance services company focused on individuals, families, and businesses, has named Marianne Peters as chief operating officer (COO). As COO, Peters will lead the company’s systems and processes that promote the mission, vision and values, drive efficiency improvements, manage training, and assist with the company’s overall strategy and plan. She previously served as Savage’s director of people and performance, and will continue to report directly to president and chief executive officer, J.R. Toland.

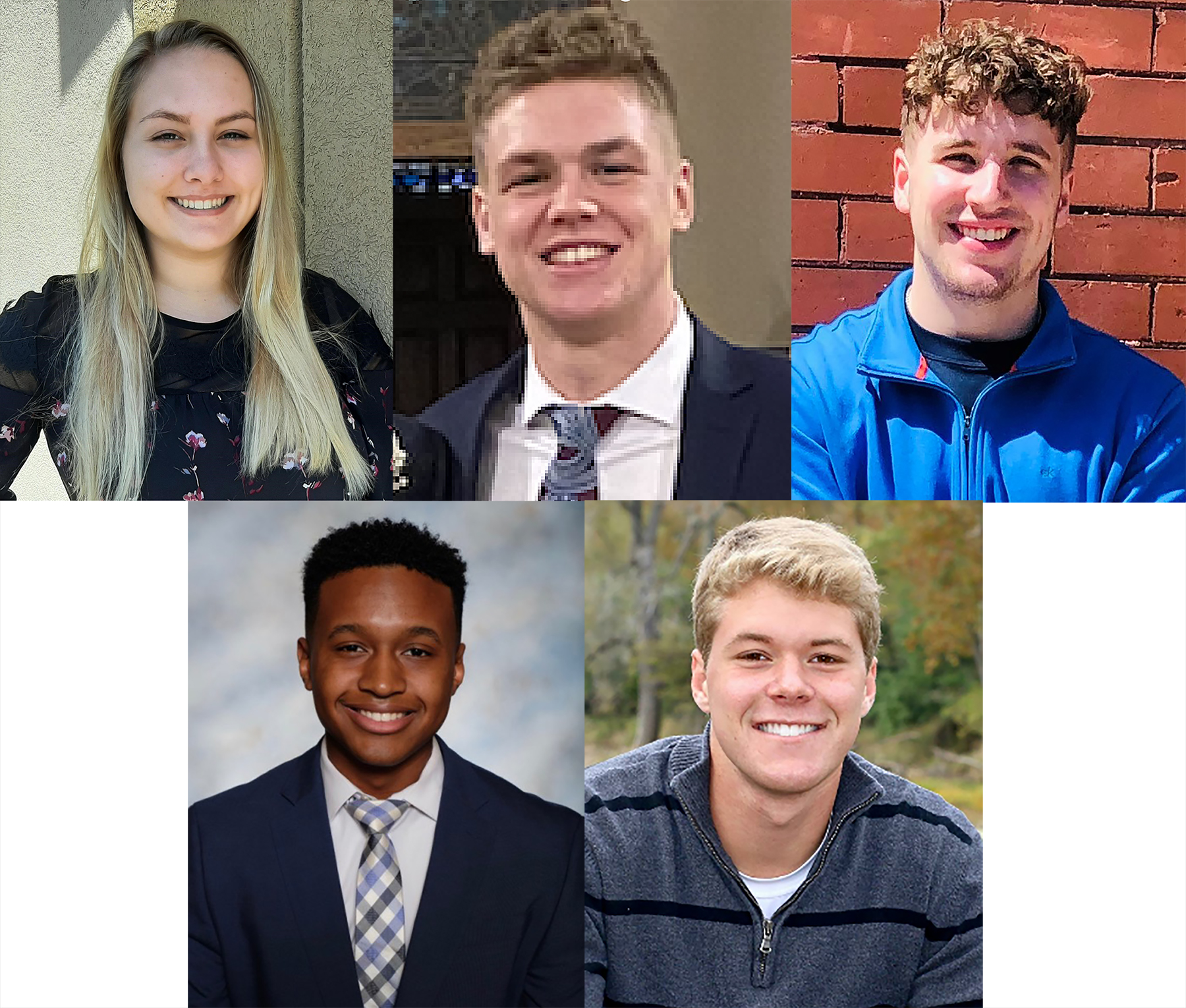

Savage and Associates announced the addition of two associates to the team – both with close ties to northwest Ohio. Lauren Hehl-Myers and Kirby McLoughlin will assist clients with saving, risk management, group health and protecting assets.

Savage and Associates announced the addition of two associates to the team – both with close ties to northwest Ohio. Lauren Hehl-Myers and Kirby McLoughlin will assist clients with saving, risk management, group health and protecting assets.

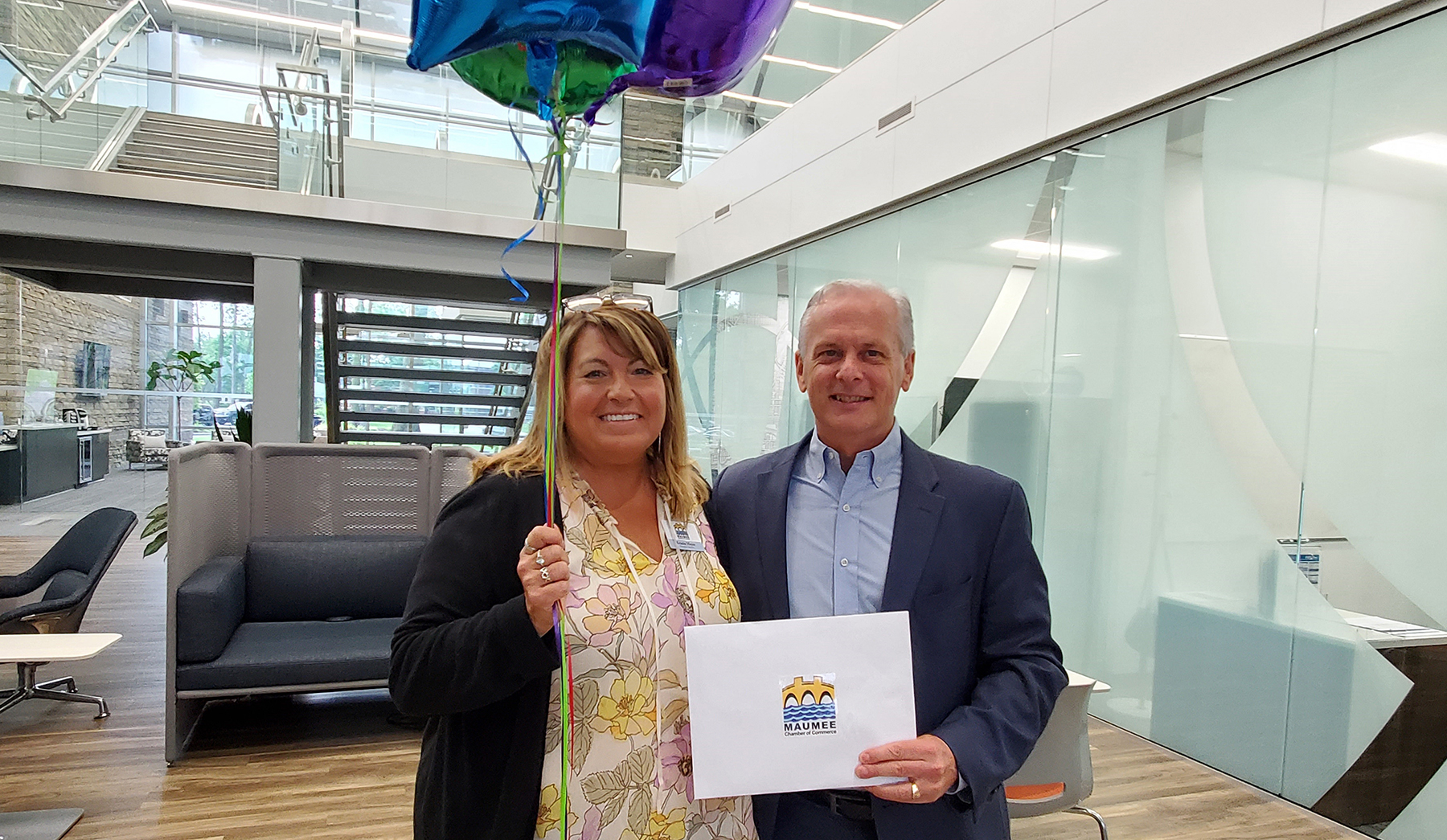

Savage and Associates has been named the recipient of the Maumee River Award from the Maumee Chamber of Commerce during their 46th annual Hometown Hero awards banquet.

Savage and Associates has been named the recipient of the Maumee River Award from the Maumee Chamber of Commerce during their 46th annual Hometown Hero awards banquet.

“We are proud to honor J.R. Toland as a Pacemaker, the criteria for which is ‘outstanding achievement in business or profession and service to The University of Toledo area,’” stated Anne L. Balazs, Ph.D., dean, The University of Toledo College of Business and Innovation. “Mr. Toland joins a long line of distinguished men and women from the Toledo area who are making a difference through their contributions to the community. This award dates back to 1963 and Mr. Toland is another shining example of an ethical and successful leader – a Pacemaker to celebrate!”

“We are proud to honor J.R. Toland as a Pacemaker, the criteria for which is ‘outstanding achievement in business or profession and service to The University of Toledo area,’” stated Anne L. Balazs, Ph.D., dean, The University of Toledo College of Business and Innovation. “Mr. Toland joins a long line of distinguished men and women from the Toledo area who are making a difference through their contributions to the community. This award dates back to 1963 and Mr. Toland is another shining example of an ethical and successful leader – a Pacemaker to celebrate!”

Tony Desch, financial advisor

Tony Desch, financial advisor

“Savage is delighted to receive this honor for the fifth year in a row,” stated J.R. Toland, president and CEO, Savage and Associates. “I am so proud of our team of more than 120 associates, across four locations, as they carried on with such dedication and optimism amid the ongoing pandemic. Our continued growth is due to having so many high-caliber, energetic people that simply love serving others.”

“Savage is delighted to receive this honor for the fifth year in a row,” stated J.R. Toland, president and CEO, Savage and Associates. “I am so proud of our team of more than 120 associates, across four locations, as they carried on with such dedication and optimism amid the ongoing pandemic. Our continued growth is due to having so many high-caliber, energetic people that simply love serving others.”