Now that we are more than one month into the new decade, let’s revisit the goals that you made: going vegan, hitting the gym, attending church, sticking to your budget, etc. As we are “adulting,” one New Year’s resolution question I got bombarded with was, “Megan, where do I put the money I am going to start saving?”

I thought this would be a good time to share the specifics of what my husband and fellow financial advisor Nick and I do for our personal finances. Let’s dive into our four-part strategy!

Annual Review

Annual Review

We sit down once a year for an annual review of our budget. Yup, that’s it. That’s how often I recommend that my clients review theirs, too. Money does not have to control your life, and I believe that revisiting your budget once a year is sufficient if you do it right.

Expenses

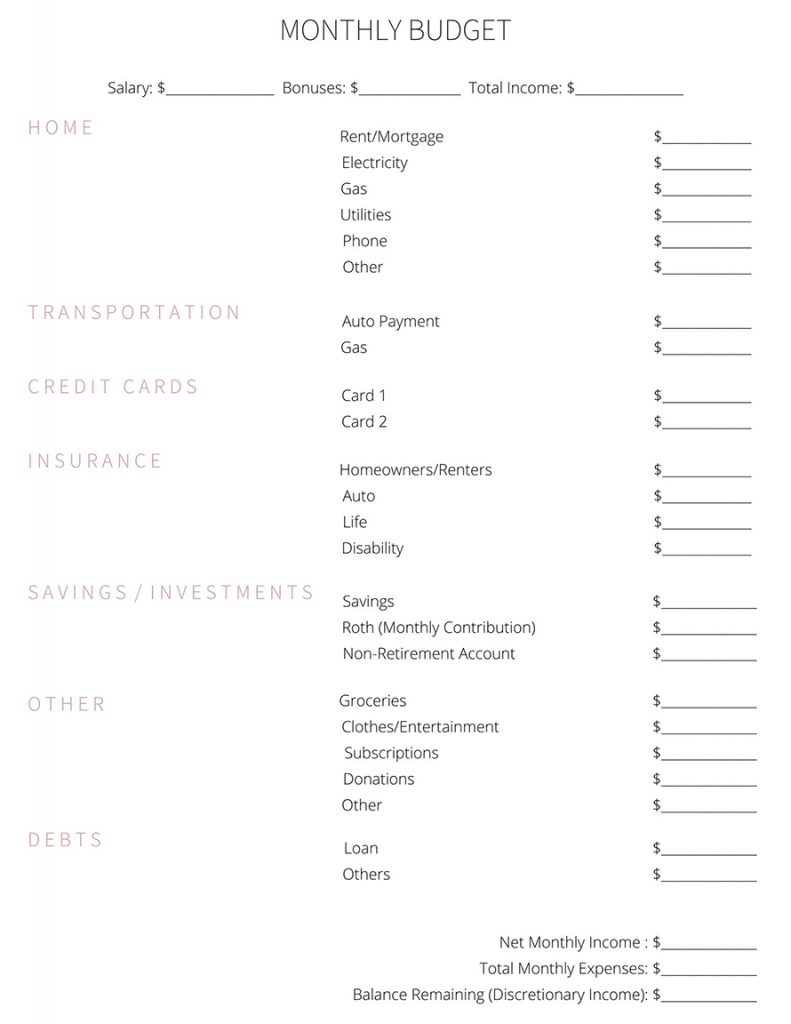

We get our pumpkin cream cold brews from Starbucks and pull out our budget sheet (see below). We use this to outline our recurring expenses, including our mortgage, groceries (aka, takeout … your girl can’t cook!), Pure Barre, our sweetest employee, Kerigan, etc. We then determine if there are any expenses we can eliminate, such as the gym across the street that I have not gone to once. (WHOOPS!) Next, we estimate expenses that do not occur monthly but know will happen throughout the year like hair appointments. Lastly, we dedicate 10 percent of our income to our church and other charities – SO many people and organizations doing awesome things in our community!

Savings

Now it’s time to add our savings to the mix. We set aside $416.67 a month to our savings account so that each year our savings grows by $5,000. We max out our Roth IRAs and Health Savings Accounts (HSA) with monthly contributions to each. We then put money toward our non-retirement investment account and our LIRPs (Life Insurance Retirement Plan). As business owners, we must factor in savings for taxes each month too – shoutout to all the 1099 business owners out there!

(Fun!) Income

At the bottom of the budget sheet, we include our take-home pay and then subtract our expenses and savings. Drum roll please (with my calculator) … we have our discretionary income, aka our FUN money! Sometimes we may only have $20 left and other times it may be $2,000. This is my, “Girl, get that dress!” money. Some months my closet is growing while other months I ask to borrow a dress from a friend (you know who you are!). Because we have done the hard part first, we have no regrets, and can truly enjoy the money we have earned.

Now that you know our process, let’s get back to you. Take a deep breath and start your own budget sheet. Make a commitment to saving so you can have some FUN! Need help with the savings piece? Holla at your girl.

Securities and investment advisory services offered through Osaic Wealth, Inc., member FINRA/SIPC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth.

Securities and investment advisory services offered through Osaic Wealth, Inc., member FINRA/SIPC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth.